Florida’s landmark 2022 and 2023 legislative changes have had a big impact on the state’s economy, thanks to lowered insurance costs that have freed up money for other investments and have attracted new companies to the state, says a report by an economic analysis firm.

The Perryman Group, based in Waco, Texas and led by often-quoted economist Ray Perryman, calculated that property-casualty insurance costs in Florida are now about 14.5% lower than what they would have been if the historic reforms had not been enacted. The savings have led to an estimated increase in business activity of some $4.2 billion and the creation of more than 29,000 jobs, the report concluded.

The country’s largest property insurance advocacy group said the report quantifies what many believed would happen with the passage of Senate Bill 2A in late 2022, a law that ended assignments of benefits and one-way attorney fees and stemmed excessive claims litigation. House Bill 837 followed in early 2023, adding broader tort reforms.

“Florida’s tort reforms are achieving exactly what policymakers intended – bringing balance to the civil justice system, reducing excessive costs, and strengthening the state’s economic foundation,” Stef Zielezienski, executive vice president and chief legal officer for the American Property Casualty Insurance Association, said in a statement this week. “The Perryman analysis confirms that these reforms are driving down insurance costs for consumers and businesses, encouraging insurers to return to the market, and generating billions in economic activity that benefits every corner of the state.”

The Perryman Group, calling itself a non-partisan research firm founded 40 years ago, said it arrived at its insurance cost savings estimates by using computer modeling that compared recent insurance rate data to the trajectory of rates before the reforms were enacted.

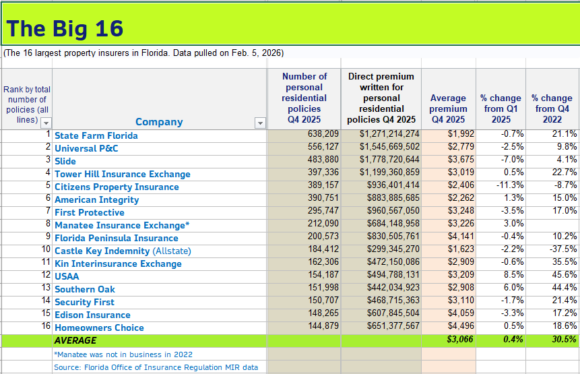

The rate numbers appear to mirror, at least to some degree, the most recent quarterly data compiled by the Florida Office of Insurance Regulation. The OIR reports show that the average premium for personal residential policies for the largest 16 property insurers in the state rose less than 1% in 2025. That’s an improvement over the double-digit increases many homeowners had seen in consecutive years before the litigation legislation was signed into law.

For 10 carriers, average residential premiums fell last year—some by as much 11%, the OIR data show. See chart.

Average premiums continued to rise significantly after the reform legislation was passed, for at least two years, just as some Florida insurers and lawmakers predicted. But the numbers appear to have turned a corner in 2025.

The Perryman report noted that the reform legislation will continue to impact Florida’s economy.

“The report notes that the benefits of tort reform will continue to compound over time, further improving Florida’s legal climate, stabilizing insurance markets, and promoting long-term economic growth,” APCIA’s Zielezienski said.

The full report can be seen here.

Topics

Florida

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter