W.R Berkley reported a “flattish” top line but nearly 15% growth in underwriting income for fourth-quarter 2025 this week. The insurer’s chief executive signaled a change in the level of rate increases going forward.

President and CEO W. Robert Berkley, Jr. said during an call with analysts that while it may be early to make a definitive call, some recent prior years seem to be “developing out” favorably. In reaction to this, he said the company is not reducing prior-year loss picks, and added, “We are not feeling, across the board, the same level of pressure to keep pushing on rate.”

Although the leader of the specialty insurer and reinsurer opened the call with some intriguing comments related to the use of AI, distributors’ competition with carriers, and evolving customer priorities, most analysts questioned Berkley on that one particular utterance about rate need.

Responding to the analysts, Berkley called out areas where his company has continued to reduce exposures, such as commercial auto. Still, the analysts did not get a lot of clarification about which lines have returns that are adequate enough to warrant less aggressive 2026 pricing in Berkley’s view, although Berkley did suggest that other liability business and small-account property where areas of opportunity for the company.

What Berkley Said About Rate Need

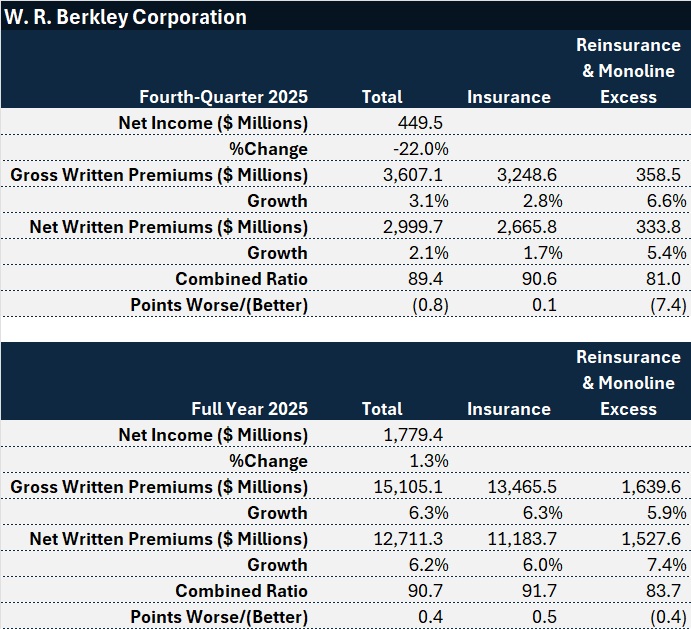

Berkley teed up the conversation about rate need by first suggesting that analysts shouldn’t read too much into the fact his company’s fourth-quarter 2025 gross written premiums only grew 3% over fourth-quarter 2024, and net premiums only 2%.

While he said that October and November growth figures “were particularly disappointing—I would call it flattish,” he reported that gross premiums for December rose 7%, without giving a segment or line of business breakdown for the month.

“I would caution people not to leap to the conclusion that what you saw for the [entire] quarter is the new reality. I think it’s quite the contrary in all likelihood,” he said, noting that midway through January, the company is “seeing some encouraging signs as relates to the top line.”

Turning to rate-specific comments, Berkley said rate growth for lines other than workers’ compensation was just over 7%.

“Given what we’re seeing in some of the more recent years, granted it’s early, but how they seem to be developing out, we are not feeling, across the board, the same level of pressure to keep pushing on rate,” he said, stressing, however, that underwriters will “continue to be diligent….”

“We will continue to stay on top of it. We are not interested in our margins eroding, but we think that we’re in a pretty good place,” he said.

Berkley said that two months don’t provide a clear picture, and that the four months (through January) reveal more topline growth. In addition, he said, “There are certain pockets of our portfolio, certain parts of the market where given the early returns on the [loss] reserves, we are thinking that [this] is a more comfortable place than we appreciated.”

Another analyst asked whether full-year premium growth, which came in at 6% for 2025, could move higher or to double-digits in 2026. While Berkley declined to offer forward-looking projections, he said, “I think the insurance business, both excess and primary, should have an opportunity to grow more than what you saw us do in the quarter.” In contrast, in reinsurance, “while we remain optimistic, we are even more so disciplined. And we can’t control the market, [which] seems to be becoming more challenging more quickly.”

Asked if loss trend is starting to moderate, Berkley said, “It’s premature to reach any conclusions with confidence, but some of the activity that we are seeing—or lack of activity in some of the more recent years—would suggest that we’re in a comfortable place,” Berkley responded. “Trend is a moving target. So, I don’t think it’s that we take our foot off the pedal, but maybe the foot doesn’t have to be stepping down on the pedal quite as hard, selectively….”

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter