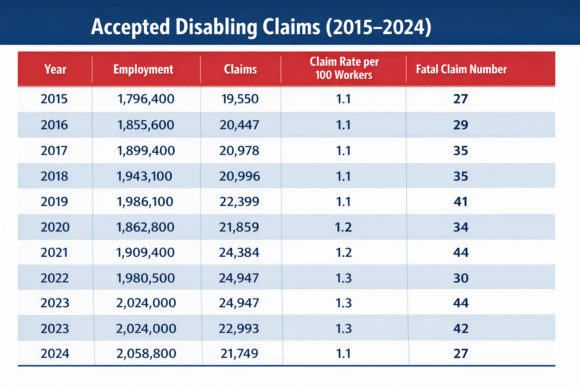

Oregon recorded fewer accepted disabling workers’ compensation claims in 2024 even as statewide employment continued to rise, new data from the state’s Department of Consumer and Business Services show.

The Oregon Workers’ Compensation Division received 21,749 accepted disabling claims last year, down 1,244 from 2023. Employment grew by 34,800 workers during the same period, keeping the statewide claim rate at 1.1 claims per 100 workers.

Fatal claims also fell sharply, from 42 in 2023 to 27 in 2024.

Healthcare, government, manufacturing, retail and transportation accounted for the largest share of disabling claims. Sprains, strains and tears made up more than half of all injuries, with back injuries alone representing 3,552 claims. Overexertion was the leading event causing injury, followed by same‑level falls and struck‑by incidents, the data show.

Transportation and material‑moving workers filed the most claims by occupation, with 4,254 cases.

Private‑sector workers accounted for 86.7% of all accepted disabling claims. Workers in their first year on the job represented 40% of claims where tenure was known.Claimants ranged in age from 14 to 90, with an average age of 41. Male workers filed 61% of all disabling claims.

Topics

Claims

Workers’ Compensation

Oregon

Was this article valuable?

Here are more articles you may enjoy.

Interested in Claims?

Get automatic alerts for this topic.