Los Angeles County District Attorney Nathan Hochman asked the county to hold off on making initial payments for a landmark $4 billion sexual abuse settlement while his office conducts a criminal investigation of potentially fraudulent claims.

In a letter to county officials, Hochman said the county should wait for at least six months before making any outlays on the abuse deal struck last year in order to avoid “irreparable loss of public funds and further harm to legitimate survivors.”

The county said Wednesday in a court filing that in response to Hochman’s request it has agreed with plaintiffs’ lawyers to deposit about $396.4 million into a settlement trust, but hold off on any payments to victims until claims undergo further vetting.

The county struck the agreement with thousands of claimants last April after a 2019 California law, known as AB 218, lifted the statute of limitations on bringing abuse lawsuits against government agencies in the state. The settlement was the largest of its kind by a public agency. Later in the year, the county struck an additional $828 million settlement with thousands more victims.

Hochman announced in November that he had launched a wide-ranging probe into fraudulent abuse claims, investigating whether some individuals were paid to file bogus suits.

“The investigation is active and ongoing and encompasses potential misconduct by claimants as well as third parties including but not limited to attorneys, recruiters, and medical professionals,” Hochman wrote in his letter to the county, which was dated Jan. 9 and included in a court filing this week.

Hochman’s office declined to comment on the letter.

Dawyn Harrison, the Los Angeles County Counsel, said “AB 218 unfortunately opened the door to fraudulent claims and exploitation at unprecedented dollar amounts.”

“This agreement today protects victims with valid claims, while ensuring that County taxpayer dollars are protected against fraud,” she said in a statement shared with Bloomberg.

The investigation could have financial implications for the county — and other agencies in the state — because there are still many pending abuse lawsuits. LA County has said it is confronting 2,500 cases in addition to those it has already settled. Many of the suits stem from physical and sexual abuse in the county’s juvenile detention and foster care programs — including many at the MacLaren Children’s Center, which closed in 2001 after officials were found to have ignored reports of abuse for decades.

Hochman said in the letter that his request for a delay is “not intended to cast doubt on the legitimacy of the claims, nor to delay justice for survivors.”

To pay for the settlement, the county was authorized to borrow $500 million in the municipal bond market and also approved across-the-board budget cuts, which it attributed to the settlement as well as the costs of last year’s wildfires.

California’s Fiscal Crisis and Management Assistance Team warned in a January report that the law that opened the door to more abuse cases would have a “substantial and ongoing financial impact” on public agencies statewide and would likely force more cuts to services.

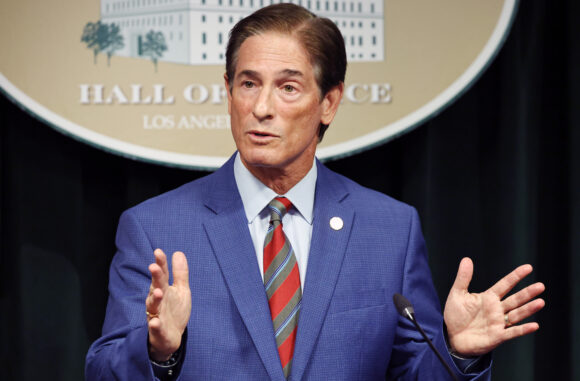

Top photo: Los Angeles County District Attorney Nathan Hochman. Bloomberg.

Copyright 2026 Bloomberg.

Topics

Fraud

Claims

Louisiana

Interested in Claims?

Get automatic alerts for this topic.