Consumers of auto insurance in the U.S. received a respite overall from several years of premium increases, but don’t tell that to drivers in some states and don’t look for it to continue.

According to online insurance agent Insurify, the average yearly annual premium for full coverage in the U.S. fell 6% to $2,144 in 2025 after the cost increased 46% from 2022 to 2024. However, the statistic may not continue this year.

Insurify said it expects a measured 1% increase in the average annual full-coverage premium in 2026 to $2,158, based on loss projections and the current rate environment.

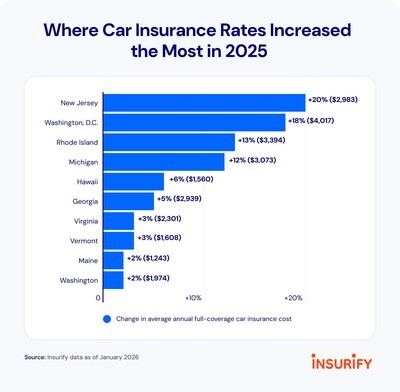

Drivers in 39 states experienced price decreases in 2025, with eight states seeing decreases of at least 15%. Wyoming, Iowa, and Arkansas each cut average insurance prices by more than 20%.

But in 2026, Insurify expects prices to increase in 35 states and fall in 15.

“Insurers have to respond to risk, and we’re seeing those risks compounding in crowded states that already have a high cost of living,” said Matt Brannon, Insurify senior economic analyst and author of the American Driver Report. “In places like New Jersey, more crashes and claims happen, repairs are more expensive, and insurers raise rates to keep up.”

New Jersey’s average premium went up 20% in 2025. The Garden State was one of four states (including Washington D.C.) that saw an average increase in the double digits last year. Drivers in Washington, D.C. paid the highest average annual cost for car insurance in 2025—$4,017, according to Insurify.

Insurify said the effect of tariffs, which has not yet been fully realized in auto repairs, remains a wildcard. Repair costs are likely to rise in 2026 and, as of now, insurers haven’t passed these costs on to consumers.

Topics

Auto

Interested in Auto?

Get automatic alerts for this topic.