Investments in global insurtech rose 19.5% during 2025 to US$5.08 billion from US$4.25 billion in FY 2024, marking the first annual increase since 2021, according to Gallagher Re’s Q4 Global Insurtech Report.

During the fourth quarter of 2025, global insurtech funding surged 66.8% to US$1.68 billion from US$1.01 billion during Q3, said Gallagher Re, noting that Q4 funding was the largest quarterly amount seen since Q3 2022 when US$2.35 billion was raised.

The reasons for the surge? Gallagher Re attributed to a combination of factors such as growing investments from insurers and reinsurers (as opposed to private equity companies); funding for insurtechs that are focused on artificial intelligence (AI), and the return of “mega-rounds” where more than US$100 million is raised in a single round.

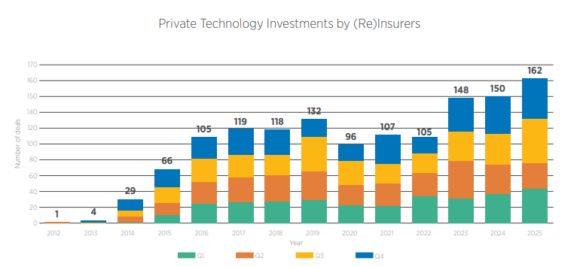

During 2025, re/insurers made more private technology investments into insurtechs – 162 deals – than any other year on record, said the report, which pointed to a “changing of the guard” or a “notable shift in the insurtech investor community.”

“This suggests that re/insurers are not only more comfortable investing, but also that they see insurtechs as a route forward in their own strategies,” the report said.

AI Investments

Regarding the effects of artificial intelligence, Gallagher noted that two-thirds of insurtech funding last year went to AI-centered insurtechs, which raised US$3.35 billion across 227 deals — 66% of funding and 62% of deals, respectively. This level of investment demonstrates the extent to which the re/insurance industry is invested in this technology, the report added.

For Q4 2025, AI-centered insurtechs raised US$1.31 billion across 66 deals, with an average deal size of US$22.14 million, or slightly above the overall Q4 2025 average, the report said, noting that 77.9% of insurtech funding during the quarter went to AI-centered companies.

“AI is squarely the focus of most of the contemporary insurtech world. Over time, we see AI becoming so integrated into insurtech that the two may well become synonymous,” said Andrew Johnston, global head of Insurtech at Gallagher Re, in comments accompanying the report.

In a forward to the report, Johnston said that three-quarters of all funding is going into insurtech businesses with an AI label – whether they are AI powered themselves or provide AI tools to other busineses.

“We do not see this trend slowing down. In fact, we see AI becoming so integrated into insurtech over time that the two may well become effectively synonymous – in much the same way as we could already argue that ‘insurtech’ is itself a meaningless label, because all insurers are technology businesses now,” Johnston said.

Mega-Rounds Fuel P/C Rebound

Property/casualty insurtech funding rebounded from 2024’s low, increasing 34.9% to US$3.49 billion in 2025, the Gallagher Re report said, explaining that mega-rounds fueled P/C’s rebound, with funding up from US$320 million in 2024 to US$1.06 billion, while deal count rose 20% to 264.”

In P/C insurtech funding, there was a 90.5% quarter on quarter hike to US$1.31 billion, driven by mega-round deals, the report said, adding that five companies – CyberCube, ICEYE, Creditas, Federato, and Nirvana – collectively secured US$662.81 million in mega-rounds during the fourth quarter.

Unlike P/C, life and health (L&H) insurtech funding and deal count both declined last year, with funding dipping by 4.6%, year-on-year, to $1.59 billion, and deal count falling 17.7% to 102, Gallagher added.

Additional notable findings from the report include:

- Tech vendors saw record-high deal shares across P/C and L&H Insurtech. Nearly 60% (58%) of P/C deals went to business-to-business insurtechs, a 12 percentage point increase from 2021’s funding boom.

- Deal shares to insurtechs in the category of lead generator/broker/MGA fell from 42% in 2024 to 35% in 2025 – the lowest on record.

- The global deal share of U.S.-based insurtechs rose 5.16 percentage points between 2024 and 2025 – the largest gain among all countries. Specifically, the U.S. deal share increased from 50.58% in 2024 to 55.74% in 2025.

- Other than the U.S., only Bermuda saw its deal share increase by more than one percentage point, year-on-year.

- Re/insurers are using AI for machine learning, data entry and classification, advanced and predictive analytics, large language models, and automation.

Topics

Mergers & Acquisitions

Trends

InsurTech

Tech

Reinsurance

A.J. Gallagher

Interested in Insurtech?

Get automatic alerts for this topic.