US insurance broker stocks were pummeled Monday as the launch of an artificial intelligence tool from privately held online insurance shopping platform Insurify sparked fears about the industry facing disruption.

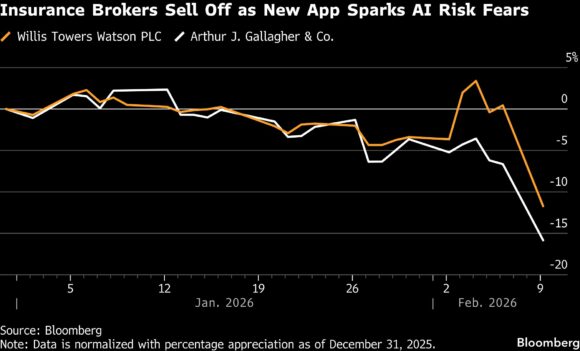

The S&P 500 Insurance index closed down 3.9%, in its biggest drop since October. Insurance broker Willis Towers Watson PLC was the worst performer in the group, closing 12% lower and suffering its worst trading session since November 2008. Arthur J Gallagher & Co. followed with a 9.9% decline and Aon PLC fell 9.3%.

“The insurance broker stocks are getting hammered,” Bloomberg Intelligence’s insurance analyst Matthew Palazola said, noting “there could be concerns about the new Insurify tool and Anthropic’s new AI tools.”

The applications “may be a threat to some consulting businesses of insurance brokers though we view them as force multiplier rather than an existential threat,” he added.

Insurify’s app uses ChatGPT to compare auto insurance rates using details about the vehicle, the client’s credit history, driving record and other inputs. The company said the app launched on Feb. 3.

Related: Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Investors’ concern about how new AI applications can upend many industries spilled over into the stock market in a big way last week, triggered by the release of new tools from AI startup Anthropic that were designed to automate work tasks related to legal and data services to financial research.

Photo: A trader is reflected in a market screen on the floor of the New York Stock Exchange (NYSE). Photo by Spencer Platt/Getty Images

Copyright 2026 Bloomberg.

Topics

InsurTech

Agencies

Data Driven

Artificial Intelligence

Tech

Was this article valuable?

Here are more articles you may enjoy.

Interested in Agencies?

Get automatic alerts for this topic.