The insurance industry has a long history of managing complex long-tail liabilities. In some cases, these liabilities grow so burdensome that they require specialized runoff solutions and as market conditions have evolved, so too have the shape of these runoff transactions and the runoff industry itself.

These legacy specialists, like all companies in the runoff sector, are essentially performing the same functions that any traditional insurer or reinsurer would in a runoff scenario. The specialist’s key differential is that they’re not really involved in actively underwriting business. Their sole purpose pivots mainly around transacting on those legacy blocks of business.

“The non-life runoff segment has the potential to become a more integral component of insurers’ overall risk management toolkit.”

This can give a specialist flexibility to focus on tasks that may be a bit more burdensome for those that are actively underwriting. It also allows the specialists to evolve into more of a capital partner, rather than just doing the runoff transactions as we’ve seen historically.

The associated risks in these transactions aren’t necessarily unique to the runoff sector. There’s also a traditional perception that all runoff business belongs in a bad business bucket. While much of the business in this area may have performed badly in the past before these runoff carriers took it on, those trends might not be indicative of future performance.

(Editor’s note: The graphics in this article were originally published on Jan. 12 in AM Best’s report titled “Non-Life Run-off – An Evolving Reinsurance Landscape.”)

The thought process here requires due diligence because this business is being repriced in real-time and can involve new assumptions and even limits that must be factored into a transaction. It is also key for runoff specialists to have an active role in claims management or oversight of the process.

Claims Management Expertise

In addition to operational relief, runoff acquirers bring significant claims management expertise to the table. Many of these specialists have built highly sophisticated claims departments with deep experience handling complex litigation, long-tail liabilities, and legacy exposures across multiple jurisdictions.

Historically, runoff transactions were executed primarily by the largest insurers and reinsurers. However, over time, a distinct class of runoff specialists have developed, carving out a well-defined niche in the insurance ecosystem. Today, these specialists are increasingly recognized for their technical sophistication, transactional agility, and ability to provide customized capital solutions.

While many acquired liabilities do pose challenges to the original insurers, the specialists gain critical advantages in the transaction process. They are able to reprice the risk, include buffers for adverse development, and, in many cases, set explicit caps on liability exposure. This underwriting discipline is supported by increasingly sophisticated data analytics, accumulated claims experience, and refined reserving methodologies.

Expanding Beyond the Niche Role

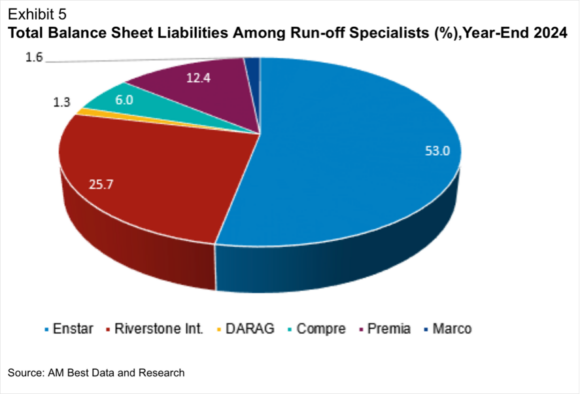

AM Best’s recent analytical report on this sector focused on six runoff specialists, including three that we have direct rating relationships with, allowing for more of an interactive rating discussion in this regard. The type of dialogue that we have with the companies in the rating relationship helps give us an understanding that can be hard to really replicate with public sources alone. This insight helped shape our key takeaways from the analysis as follows:

- Runoff specialists have evolved from niche players handling distressed portfolios to key strategic partners helping insurers optimize capital, simplify operations, and refocus on core business.

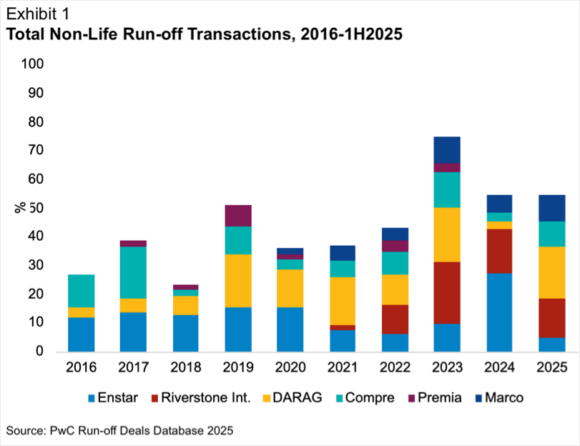

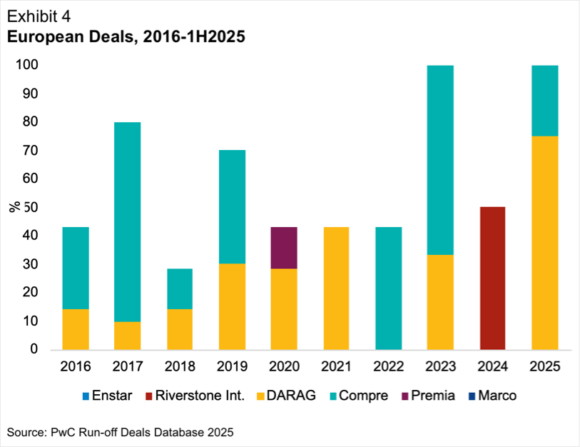

- The global non-life runoff market has become increasingly concentrated, with a handful of dominant players accounting for most recent transaction activity.

- Runoff specialists act as a stabilizing force for the broader insurance ecosystem, absorbing legacy risks and enabling insurers to maintain agility through regulatory requirements and capital market volatility.

Most of what we know today about the runoff market originated from the liability crisis in the

1980s. However, the prominent standalone runoff carriers didn’t surface until the mid-1990s or early 2000s with the formations of Cavello Bay Reinsurance (Enstar) and Riverstone International.

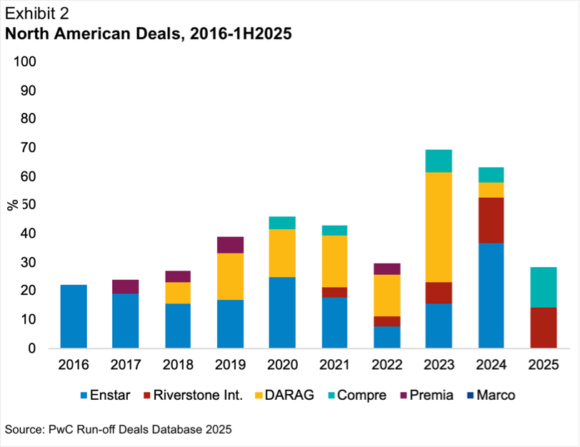

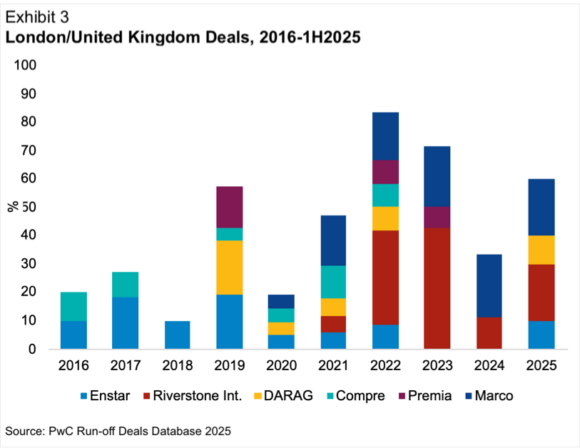

Enstar and Riverstone International have emerged as the primary drivers of recent deal activity. Enstar has been a dominant force in the North American market for nearly a decade, accounting for roughly 20% of all North American non-life runoff transactions since 2016.

Riverstone, meanwhile, has stepped into a leading position in the United Kingdom and London market, where it has captured approximately 29% of deal flow since 2022. In our view, this concentration could begin to soften as each carrier looks to diversify its portfolio risk and sustain growth at scale.

So, this market as we know it today is only somewhere between 30 and 50 years old. When you compare it to the insurance industry that’s been around for a century-plus, the runoff sector is still quite young.

It’s a segment that’s more or less mastered the bread-and-butter acquisitions, via the structured transactions, such as adverse development covers and loss portfolio transfers. However, there’s a froth of young, ambitious talent within this industry that is looking to evolve and advance this model.

One recent example is Enstar’s acquisition of Accident Fund Holdings Inc., which mainly underwrites workers’ compensation coverage. That’s a business segment in which Enstar has extensive experience managing reserves, and has outperformed the workers’ compensation industry.

What Could Come Next?

AM Best notes the non-life runoff market has settled into a more defined role in recent years, having seen both the exit of certain participants and the emergence of new entrants. Despite this turnover, the overall number of active runoff companies has remained relatively stable.

With the lingering perception of legacy solutions associated almost exclusively with distressed or troubled books of business dissipating, the narrative surrounding runoffs has begun to shift. In recent years, runoff platforms have been used to deliver third-party finality in merger & acquisition transactions, and facilitate orderly exits for casualty insurance-linked securities investors. These developments demonstrate that legacy solutions can serve a broader strategic purpose beyond simply managing problematic reserves.

As the market continues to mature, the non-life runoff segment has the potential to become a more integral component of insurers’ overall risk management toolkit. Today, insurers dedicate significant time and resources to designing prospective reinsurance programs yet often overlook retrospective risk management unless an issue arises.

Topics

Carriers