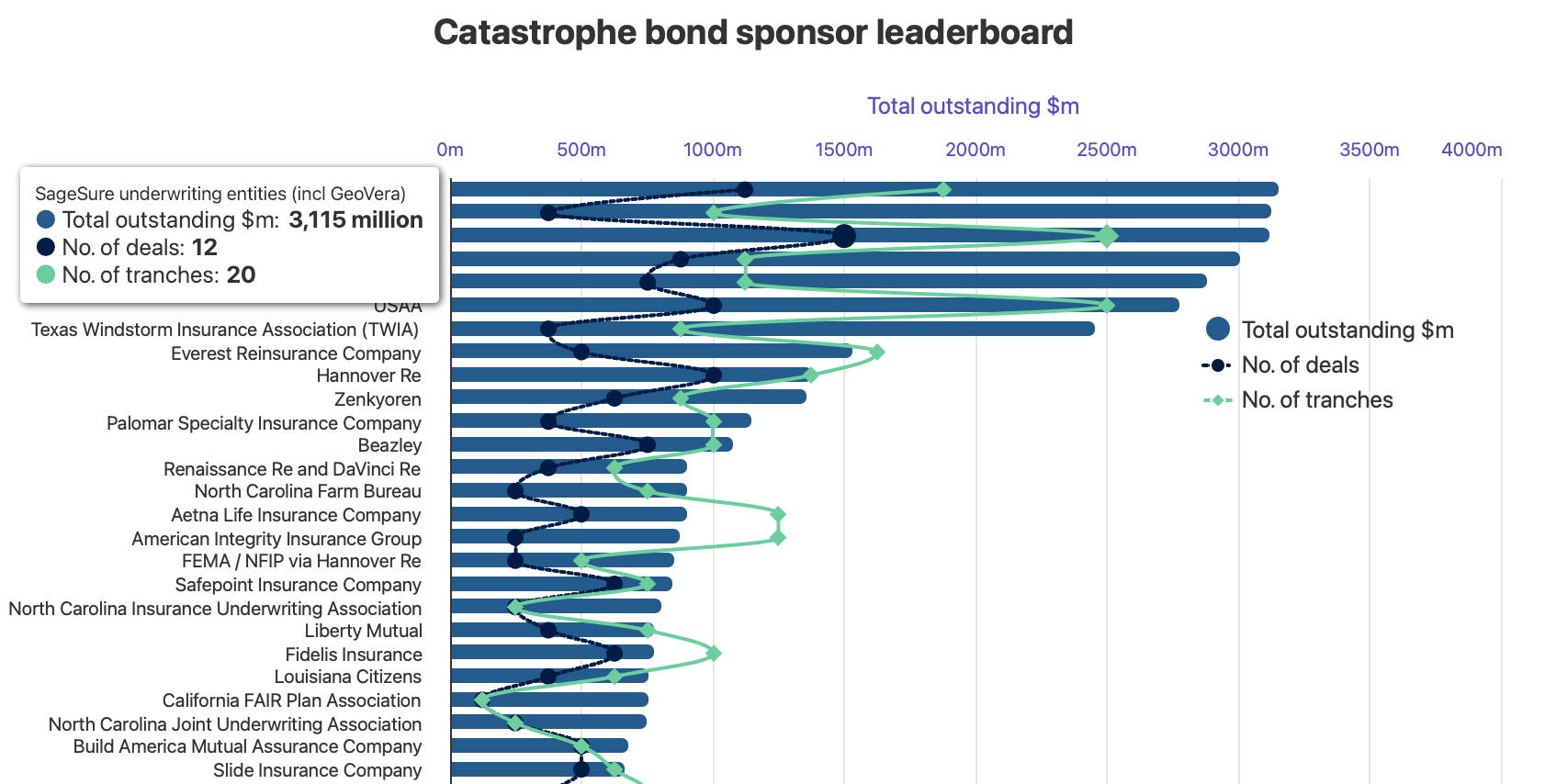

SageSure, the fast-growing catastrophe-exposed property specialist MGU, has now moved up to third in the Artemis catastrophe bond sponsor leaderboard, with just over $3.1 billion in risk capital outstanding across cat bonds for related underwriting entities, thanks to the closing of its largest $670 million Gateway Re Ltd. (Series 2026-1) issuance.

SageSure initially sought $765 million of protection with this new catastrophe bond offering when the deal first emerged back at the middle of January.

Then, in our first update on the transaction, the size target was lowered slightly to between $645 million and $690 million, while the price guidance remained the same for each of the five classes of notes being offered.

In the end, SageSure successfully priced the notes for this Gateway Re 2026-1 catastrophe bond in the first week of February, to provide it with $670 million of reinsurance limit, the largest in the series of deals, with different pricing outcomes depending on the layer of risk although and all spreads finalised within the initial guidance.

As we’d explained, this is the broadest offering in the Gateway Re series of cat bonds so far, securing multi-peril cover (previously they were all named storm focused) and regional protection across a wider range of states for SageSure, as the company looks to continue to deeply integrate capital markets investor sourced limit via cat bonds within its reinsurance towers.

Now settled as of yesterday, with our data and charts including this new cat bond from SageSure, it has lifted the company up to third in our catastrophe bond sponsor leaderboard, the highest position it has ever occupied.

SageSure itself has just highlighted this notable achievement in a press release on the successful closing of its largest Gateway Re cat bond yet.

The company stated, “With the close of this transaction, SageSure-supported franchises have $3.1 billion in outstanding notional limit, solidifying SageSure’s place as the third largest catastrophe bond sponsor in the world.”

Our catastrophe bond sponsor leaderboard is the only ranking of this kind, which is updated as every new cat bond issuance settles and as transactions mature.

Terrence McLean, President and CEO of SageSure, commented, “SageSure is proud to be a champion of the expansion of ILS and the cat bond market. This $670 million in capacity is not only the largest in our program’s history but also a signal that the Gateway Re franchise has become a cornerstone of the global ILS market.

“SageSure will continue to innovate in the ILS and cat bond markets so that we can bring the most competitive products to market.”

“We are grateful for the strong investor support for the Gateway Re series. This issuance exemplifies the important role of capital markets within our broader reinsurance strategy to support our growth,” added Ed Konar, President of SURE, one of the beneficiaries of this latest Gateway Re cat bond to settle. “We look forward to expanding our programs with SageSure to bring stable capacity to more catastrophe-exposed communities.”

Swiss Re Capital Markets Corporation played the sole structuring agent and bookrunner roles for the new cat bond.

“This transaction marks a significant milestone for the Gateway Re franchise,” explained Jean-Louis Monnier, CEO of Swiss Re Capital Markets Corporation. “The scale of this transaction combined with the successful inclusion of secondary perils across different risk layers further demonstrates investors’ appreciation for SageSure’s transparency and underwriting discipline and positions ILS as a core component of their reinsurance strategy.”

In our cat bond sponsor leaderboard, SageSure related entities now account for $3.115 billion of risk capital outstanding, from across 12 issuances featuring 20 tranches of placed cat bond notes.

Which puts the company in third place, behind only Florida Citizens and Allstate.

SageSure and its related entities will likely move up to second place very soon, as there is another Gateway cat bond in the market.

As we reported recently, the MGU is also in the market right now with another cat bond that seeks multi-peril reinsurance protection for the Auros Reciprocal Insurance Exchange and Interboro Insurance Company, with a Gateway Re Ltd. (Series 2026-2) issuance targeting $175 million of coverage.

If that target is hit, then SageSure will rise up to second in the cat bond sponsor leaderboard, with potentially $3.29 billion or more in catastrophe bond backed reinsurance outstanding.