Short Answer: Most small businesses benefit from working with an insurance agent. Online insurance is faster, but agents help prevent coverage gaps, compare multiple carriers, and provide claims support. Given that 77% of small businesses are underinsured, professional guidance reduces costly mistakes.

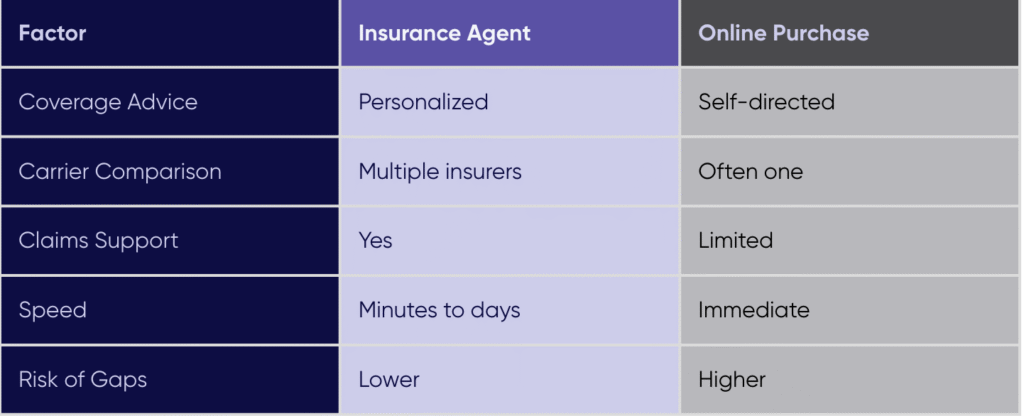

Insurance Agent vs. Online: Key Differences

Online platforms focus on speed. Agents focus on protection accuracy.

Why Working With an Insurance Agent Often Provides Better Protection

1. Most Small Businesses Are Underinsured

According to Hiscox (2025):

- 77% of small businesses are underinsured

- 90% are unsure if they have enough coverage

- 96% could not correctly define general liability coverage

Underinsurance often happens when owners:

- Buy only what is legally required

- Misunderstand exclusions

- Skip professional or cyber liability

An agent helps identify risks that online forms may not detect.

2. Agents Compare Coverage Across Carriers

Independent agents shop multiple insurers. That means they can:

- Recommend appropriate limits

- Match your business with the right carrier

When buying direct online, you typically see only one company’s policy.

3. Agents Help You Understand What Your Policy Covers

Many owners misunderstand basic coverage types.

Business Owners Policy (BOP)

Combines:

- Often business interruption

General Liability

Covers:

- Property damage you cause

Does not cover:

Professional Liability (E&O)

Covers:

If you’re unsure which of these apply to your business, an agent can clarify before a claim exposes a gap.

4. Claims Support Matters

When a claim happens, your agent:

- Helps submit documentation

- Communicates with the carrier

- Advocates for timely resolution

Online platforms typically offer customer service, not representation.

The Financial Risk of Choosing the Wrong Coverage

Insurance gaps can be expensive.

Other common claims include:

- Professional negligence

Without proper coverage limits or the right policy type, those expenses may come out of pocket.

When Buying Online May Be Appropriate

Online purchasing can work if:

- You are a solo business

- Your operations are simple

- You understand coverage types

- You need basic general liability only

Online platforms provide:

For straightforward risks, this may be sufficient.

When You Should Use an Insurance Agent

Consider working with an agent if:

- You operate in multiple states

- You own equipment or inventory

- You provide professional advice or services

- You are unsure what coverage you need

If your business is evolving, your insurance should evolve with it.

Does Using an Agent Cost More?

Typically no.

Agents are compensated by insurance carriers. Independent agents often compare pricing across insurers, which can result in competitive premiums.

The greater financial risk is not agent compensation, it is inadequate coverage.

Final Takeaway

Online insurance offers convenience. An insurance agent offers strategy.

Given how common underinsurance is among small businesses, professional guidance can reduce exposure to costly coverage gaps and ensure your policy matches your actual operations.

Find a Coterie Insurance Agent

Coterie Insurance partners with independent agents who combine modern technology with professional expertise.

They can:

- Compare multiple coverage options

- Explain policy terms clearly

Find a Coterie Insurance agent and get personalized guidance today.