Some supertanker operators, nervous about rising US-Iran tensions and potential risks to shipping in the Strait of Hormuz, are speeding their vessels through the chokepoint.

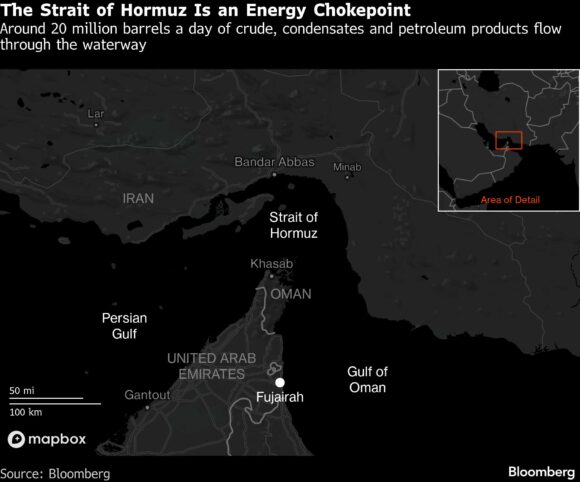

Very Large Crude Carriers are traveling around the narrow, congested waterway — through which about a quarter of the world’s seaborne oil trade travels — at as much as 17 knots, ship-tracking data show. About 13 knots is the usual top speed for a fully laden VLCC, which is typically about 330 meters (1,080 feet) long and cumbersome to maneuver.

Some operators began the measures after Iran said it would conduct live-firing drills last week, according to shipowners and brokers that dispatch vessels through the waterway. The OPEC producer this week issued at least two warnings that they would commence live-firing exercises around the region, although none were observed, according to people with knowledge of the matter.

The development adds more uncertainty to volatile freight markets, which have spiked after tensions over Iran combined with tight vessel supply. The US continues to build up its military presence in the region as talks between Washington and Tehran kick off in Oman later on Friday. However, Iran has suggested the discussions won’t yield a quick resolution to tensions between the two countries.

“Even when headline geopolitical risk cools, Hormuz remains a complex operating environment,” said Angelica Kemene, head of Optima Shipping Services’ market strategy team in Athens. “Shipowners are exercising caution over journeys that may take days to complete in the corridor.”

Iran has previously threatened to lock down the Strait of Hormuz, though it has never actually followed through. Earlier this week, the Islamic Republic “harassed” a US-flagged oil tanker as it was transiting through the waterway.

Meanwhile, some operators are making vessels wait off the United Arab Emirates port of Fujairah ahead of traveling through the chokepoint as they finalize berthing and cargo-loading dates within the Persian Gulf, shipowners and brokers said. The gulf contains the main oil-loading facilities for producers including Saudi Arabia, Iraq and Kuwait.

The speeding-up by some supertankers adds to the dangers of navigating the congested waters, where there’s an increased presence of warships and where aging, dark-fleet vessels are known to congregate. However, not all vessels have accelerated — with many appearing to be traveling at more normal speeds of 11 to 13 knots.

The DHT Jaguar is among the supertankers to have increased speed, after loading almost 2 million barrels of Kuwaiti crude on Sunday, ship-tracking data from Bloomberg, Kpler and Vortexa show. It clocked almost 16 knots while exiting Hormuz.

The V. Harmony, a VLCC that’s set to pick up a cargo from a Persian Gulf port in the UAE, approached Oman from Asia this week at speeds of around 11 knots, before speeding up on Thursday to enter Hormuz at almost 17 knots.

A spokesperson for DHT Management that’s listed as the manager for DHT Jaguar on international maritime database Equasis said the company doesn’t comment on ship-specific trading. Sinokor Merchant Marine, which Equasis says is V. Harmony’s manager, did not respond to emailed requests for comment.

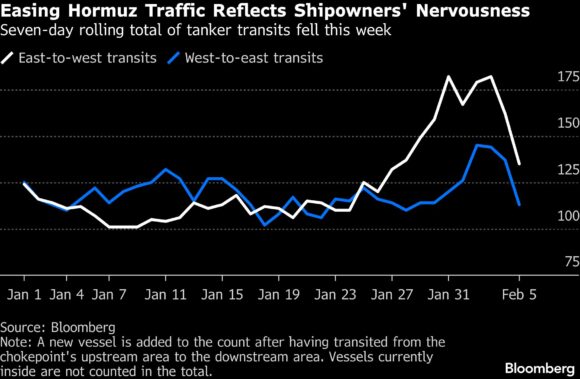

Total tanker traffic through the Strait of Hormuz has eased slightly — with 135 crude and products carriers entering the waterway on a seven-day rolling basis on Thursday, down from 182 on Jan. 31, ship data show. The number exiting the chokepoint fell to 113 from 120 in the period.

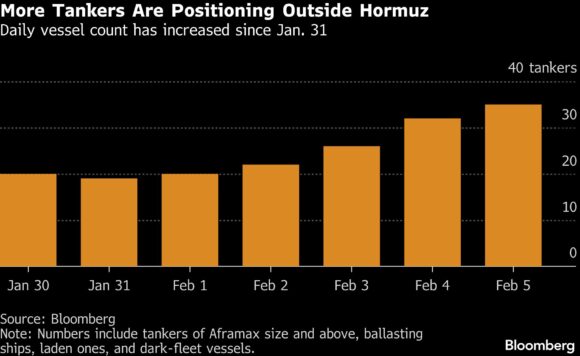

Other supertankers looking to load cargoes in the Persian Gulf are first loitering off Oman, as fixers firm up berthing and crude-loading dates before entering the waterway, the shipowners and brokers said. The pool of individual vessels of Aframax size and above positioned outside the Strait of Hormuz has risen each day since Iran announced its live-firing drill.

Making vessels wait outside the chokepoint also gives shipowners time to renegotiate additional war-risk premiums for insurance purposes, although those levies have yet to rise, some of the people said.

Top photo credit: Ali Mohammadi/Bloomberg

Copyright 2026 Bloomberg.

Topics

USA

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter