The late January winter storm will caused insured losses of $6.7 billion, making it one of the costliest winter storms since 1950.

The estimate comes from catastrophe modeler KCC, headed by modeling pioneer Karen Clark. The tally includes privately insured losses from damage to residential, commercial and industrial properties from the snow, ice, wind, and deep freeze that engulfed more than half of U.S. states, affecting about 200 million people starting on Jan. 23 and lasting until Jan. 27.

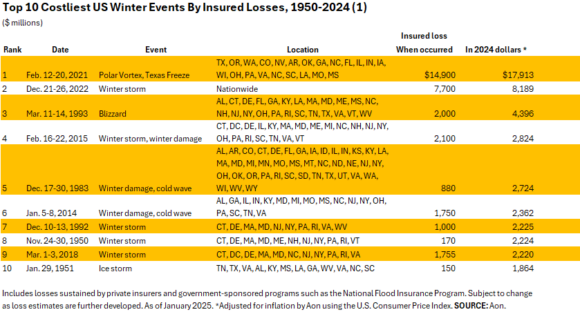

If KKC’s estimate is accurate, Winter Storm Fern will the third costliest winter event to insurers.

Fern’s freezing temperatures caused the most damage, followed by the snow and ice. Fallen trees and power lines caused widespread outages southern New Mexico and Texas up to Kentucky. Austin, San Antonio, and Houston recorded record low temperatures.

Losses were highest in the states of Texas and Tennessee, said KCC.

The most outages were in Louisiana through north Mississippi, into Tennessee. Prolonged outages increase the chance of damage, especially from frozen pipes. These effects will likely be more pronounced in the southern and southeast states since properties are usually not constructed the types of low temperatures seen in Fern. Commercial properties were more significantly damage than homes. KCC said said commercial claims are, on average, generally much higher than residential.

Photo: A man walks past a car damaged by a tree that fell during an ice storm, in Oxford, Miss. on Jan. 26. (AP Photo/Bruce Newman)

Topics

Profit Loss

Windstorm

Was this article valuable?

Here are more articles you may enjoy.

Interested in Profit Loss?

Get automatic alerts for this topic.