Zurich Insurance’s bid to buy British insurer Beazley will set the stage for further deals in the sector as buyers jostle for exposure to the lucrative specialty lines market, analysts, industry advisers and a broker said.

London-listed Beazley said on Wednesday it was likely to recommend a sweetened 8 billion pound ($10.93 billion) approach from the Swiss insurer if it makes a formal offer at that price. It previously rejected multiple proposals from the company.

Should the deal go through, Zurich will gain a substantial footprint in the historic Lloyd’s of London insurance market and widen its exposure to high-growth areas like cyber insurance, where Beazley has been among the industry front-runners.

Read more: Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

This will in turn fuel interest in other listed firms as buyers look to capitalize on sluggish valuations and tap longer-term growth in the specialty lines insurance market, eight analysts, industry advisers and a broker said.

Setting the Stage for Multi-Year Consolidation

“Softening pricing across key commercial classes typically sets the stage for a multi‑year consolidation cycle,” said Salman Siddiqui, an associate managing director at Moody’s Ratings. “Large transactions like the proposed Beazley deal highlight how global insurers are positioning for scale, particularly in specialty lines, as margins compress.”

Hiscox, which has a retail insurance business as well as a presence at Lloyd’s, could be among those targeted, six analysts and advisers said. Lancashire, a Bermuda-based insurer listed in London, could also attract interest from buyers, three of those people added.

Among potential buyers are large Japanese insurers looking to put their cash to use, analysts said. A flurry of Japanese financial firms have invested in overseas financial firms to drive growth in recent years, including Sompo’s acquisition of New York-listed reinsurer Aspen last year for $3.5 billion.

European insurers are also looking to position themselves for growth in areas of the market like artificial intelligence and data centers, said Ben Cohen, co-head of European Insurance Equity Research at RBC Capital Markets.

“It’s an attempt to future-proof some of their business models,” Cohen added.

Conduit Holdings, a London-listed reinsurance specialist, could be among the potential targets, Cohen and another of the people said. After sliding to a loss in the first half of 2025, the firm faced pressure from an activist investor to signal it was up for sale.

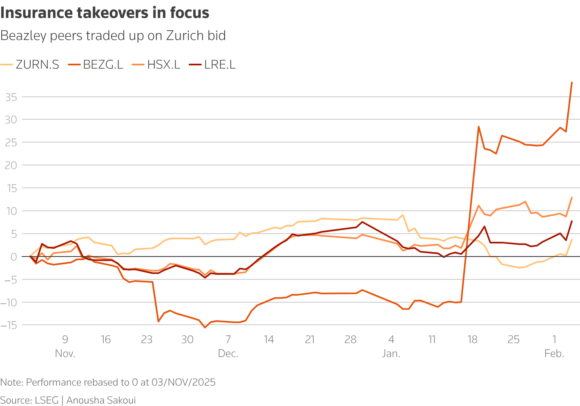

Shares in Conduit, Hiscox and Lancashire have climbed since Zurich went public with its interest in Beazley on January 19. Conduit and Lancashire declined to comment. Hiscox did not respond to requests for comment.

Pricing the Deal

The hefty premium offered by Zurich shows that listed insurers are currently undervalued, analysts said. At 8 billion pounds, the latest proposal marks a 62.8% premium on Beazley’s share price of 820 pence on January 16, before Zurich went public with its interest in the company.

Beazley has attracted among the highest price-to-tangible-net-asset-value multiple of any listed London insurer previously, according to RBC analysts. Analysts at Panmure Liberum said Zurich could afford to pay more given the strategic value of Beazley and the synergies it could realize from the deal.

All of the people Reuters spoke to cautioned that the multiples attached to Beazley could not be applied directly to other listed insurance companies and all the businesses have differences. Hiscox’s large retail division could mean it fetches a higher multiple than that implied by Beazley, while Lancashire’s mix of wholesale and reinsurance would likely attract a lower premium, RBC analysts said in a note.